How do you take your leverage? Do you like 2x, 3x, or more? While leverage can be a good thing, it can really hit investors hard if they don’t understand the product they’re trading. A popular way to gain leverage is through leveraged ETFs. The idea of getting two or three times the return on a directional move in an index is really appealing on the surface. However, many don’t understand how daily resetting may impact their returns if held overnight. The compound returns of these funds can either accelerate returns or lead to higher risk and lesser returns. Let’s take a closer look at the backstory of positive and negative compound returns of leveraged ETFs.

The Negative Backstory

A backstory is designed to provide some historical context to better understand the present. There probably isn’t a better historical example of negative compounding than ProShares UltraShort Financials (NYSEARCA: SKF) during the height of the financial crisis. This backstory is important since we may be on the cusp of a major move lower in the equity markets.

Here is the investment objective of SKF according to the ProShares website:

“ProShares UltraShort Financials seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the daily performance of the Dow Jones U.S. FinancialsSM Index.”

If you were bearish on the financial sector, there wasn’t a better time than 2008, am I right? Before we get to the performance, let’s read the cautionary note on the ProShares website regarding SKF:

“Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different from the target return, and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks.”

You’ve probably heard these types of warnings if you’ve ever traded these products, but how bad can it really be? Most think that the tracking of these products is just a little off, and most of the time you’re right. However, I had the opportunity to speak with many traders that were confounded by SKFs performance in 2008, and I will tell you that none of them understood the impact of negative compound returns.

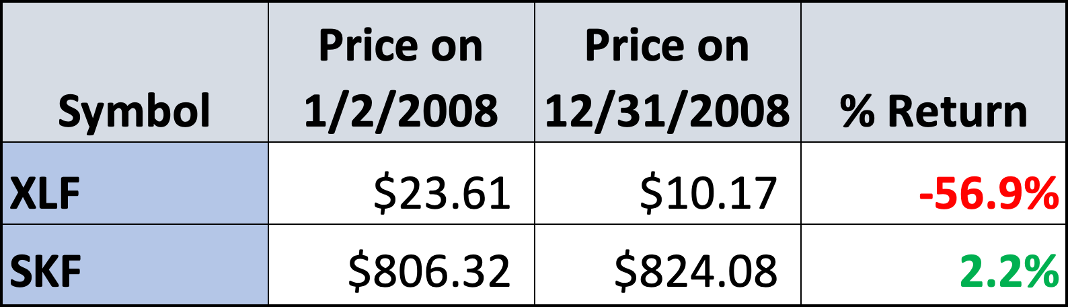

SKF Returns in 2008

I know, you’re ready to know what happened in 2008. In the cautionary note above, Proshares talks about potential issues with “volatile benchmarks.” Volatility was abundant in financial stocks in 2008. It was fraught with large drops and rips higher following some announcement over the weekend by the U.S. Treasury Department or the Federal Reserve. As a result, the fund opened on January 2, 2008, at $806.32 on a split-adjusted basis. It finished the year on December 31, 2008, at $824.08. That amounted to a 2.2% return if you held the fund for the entire year.

Based on that return number you might assume that financials didn’t do that poorly, but you would be wrong. In contrast, the Financial Select Sector SPDR Fund (NYSEARCA: XLF) lost 56.9% of its value over the same period!

The Positive Backstory

What is a backstory without a hero and a villain? I guess you could call this the hero backstory. The issue with tracking errors is that they can work against you but can also work for you. This tends to happen when there are few countermoves in the price. A highly directional melt-up would be a good example and what better example of a melt-up than following the COVID crash. For this example, we’re going to look at the performance of the Direxion Daily Small Cap Bull 3X ETF (NYSEARCA: TNA). Here is how Direxion describes the objective of TNA and the companion bearish ETF TZA:

“The Direxion Daily Small Cap Bull (TNA) and Bear (TZA) 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the Russell 2000® Index. There is no guarantee the funds will meet their stated investment objectives.”

Based on the SKF backstory, you know why they’re not guaranteeing returns, especially for longer than one day. However, the inability to track the benchmark overtime isn’t all negative. In fact, it can be highly positive.

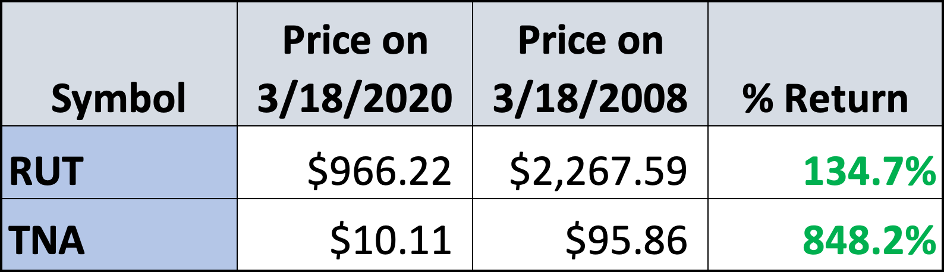

The Russell 200 reached its COVID crash low on March 18, 2020, at $966.22. One year later on March 18, 2021, the Russell closed at $2267.59. That amounted to a 57.3% return in one year. I guess that’s what $5 trillion in Fed stimulus will get you.

Over that same period, TNA rose from $10.11 to $95.86. That is an 848.2% return in one year!

What this shows is that the negatives of leveraged ETF compounding are about equal to the positives of compounding. The only question is when should you consider holding a leveraged ETF for more than a day?

When to Invest?

While the above examples are extreme, the intent is to understand the potential impact of daily compounding. One of the morals of the bearish backstory is that returns are fairly uneven in a bearish trend. While the market can move in a straight line, at times, it’s frequently characterized by short squeezes that lead to big countertrend moves. This type of move happened recently in the major market indices from March 14 to March 29. These types of moves can be hard for someone holding a bearish leveraged ETF hoping for a major correction.

However, bullish trends typically see highly directional moves with very few down days. These types of moves typically occur following bigger corrections. That means when markets melt up the compound daily returns can be highly positive.

This is a topic that Don Kaufman, co-founder of TheoTrade, and our other instructors have highlighted many times in our Member Chat Room, which broadcasts during trading hours.

How to Invest?

At TheoTrade, we have an options and futures focus on trading. The advantage of options is that it can provide leverage with defined risk. We have many classes that teach various strategies that are reinforced in our daily Member Chat Room and with our trade alerts. This helps our members learn how to truly apply a strategy. Two of these strategies are long verticals and call ratio backspreads. With these two strategies, you’re able to account for the volatility skew that is present in these leveraged products.

Gaining an Edge with Volatility Skew

I’m not going to delve deeply into volatility skew but understanding this topic and how to trade it is important. For indices, the skew is characterized by falling call implied volatility and rising put implied volatility when moving out-of-the-money (OTM). This is a result of the downside crash risk of the market, which was realized following the 1987 crash.

Understanding skew and how to trade it is paramount. The general idea of options spread trading is to buy the lower implied volatility option and sell the higher. The result of applying this is lowering the cost of the trade and increasing the reward. Let’s apply skew to our understanding of leveraged ETF returns.

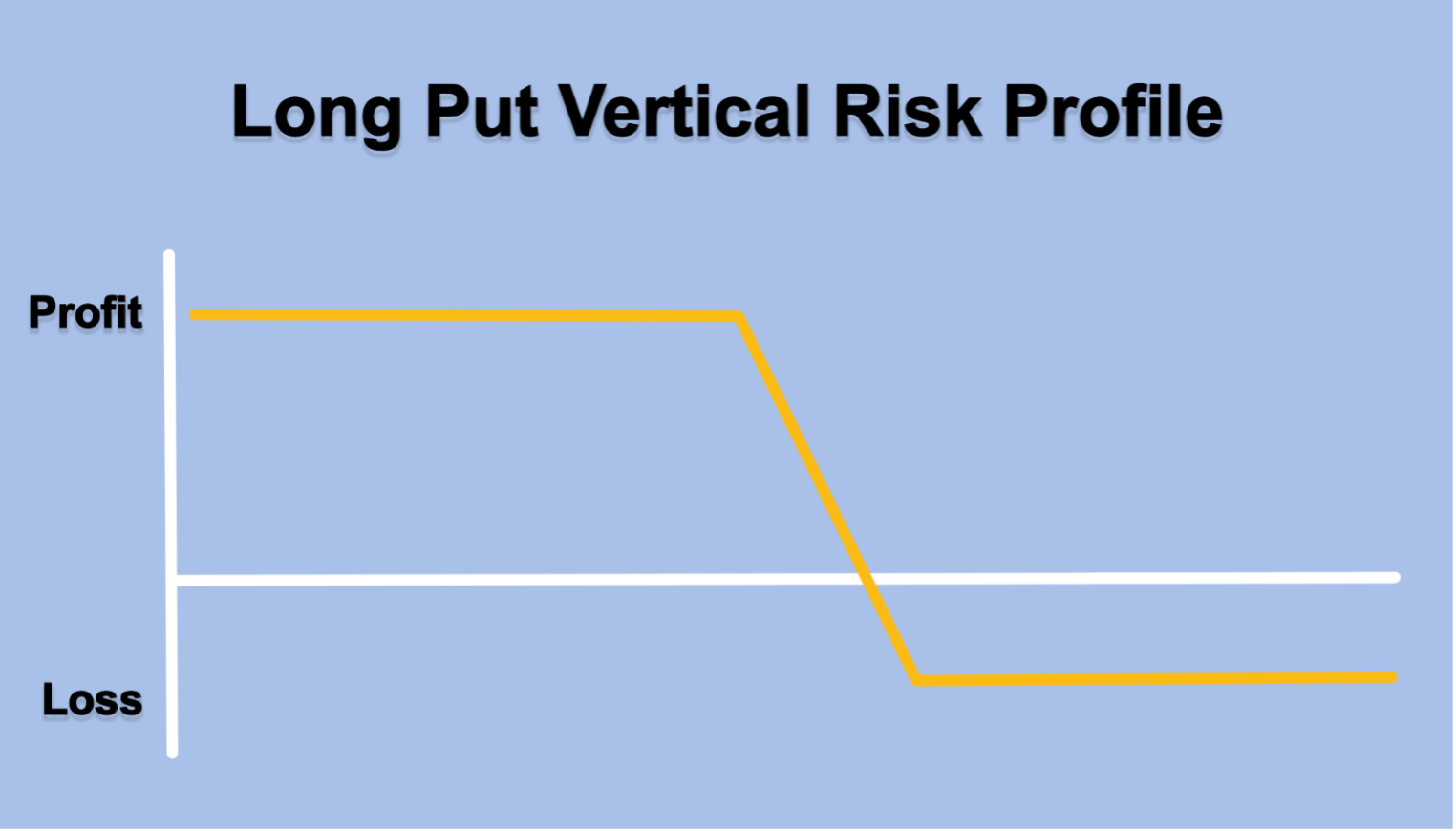

Vertical Spreads

While buying a leveraged inverse ETF can work in a downward trend, there’s a lot of difficulty with this approach. As a result, it may be better to gain leverage through options using a product that will track the benchmark. In the example of SKF, you may want to consider buying an OTM long put vertical on XLF. This provides you with a high reward to risk and an ability to capitalize on a large down move. The high reward to risk is helped by the high skew environment that we’re in. Then imagine if you sold some put premium to pay for the put spread so that you have no out-of-pocket cost or upside risk. Now we’re talking another strategy called an Inflection Point Spread.

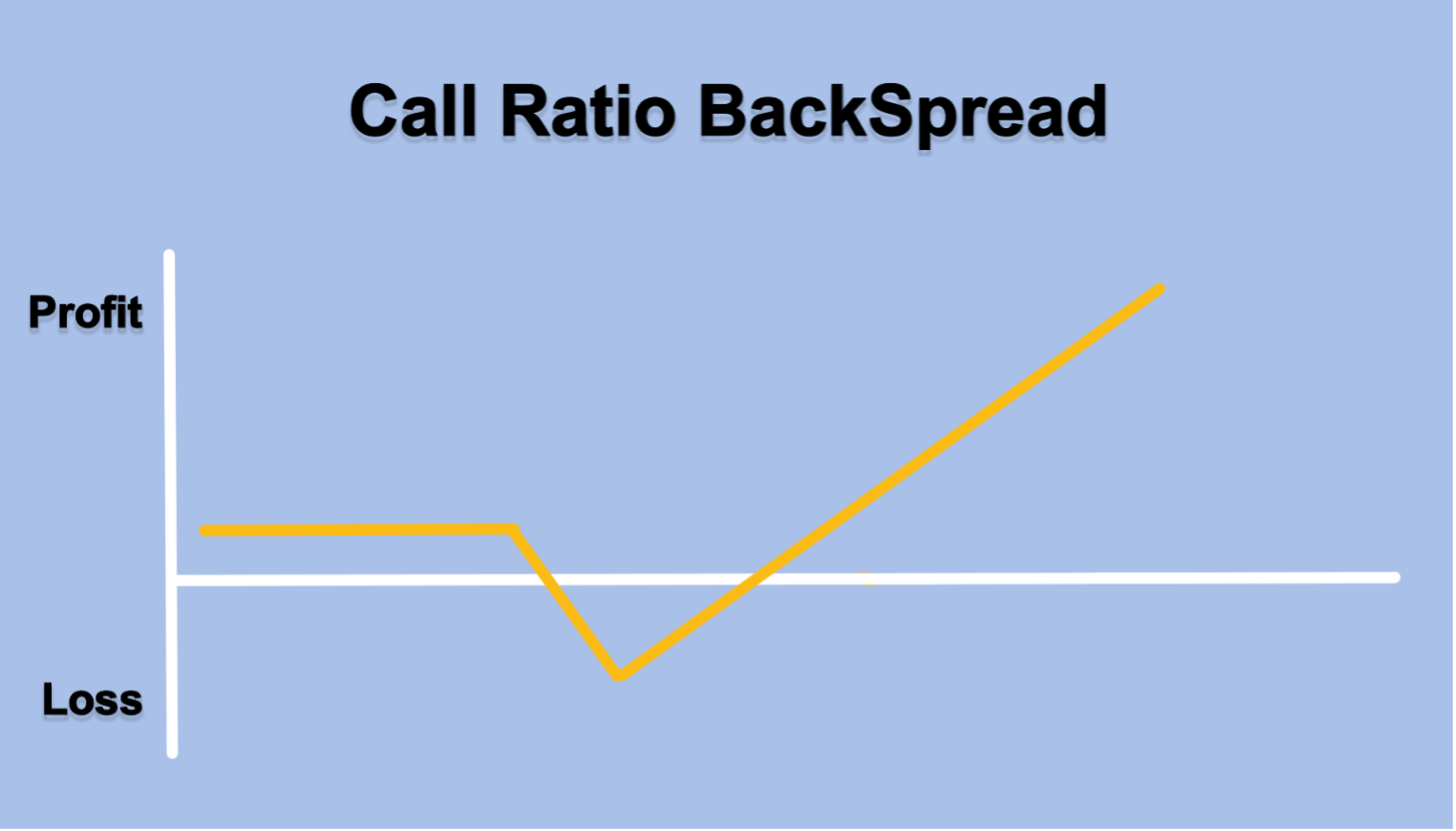

Call Ratio Backspreads

In a bullish environment, trading vertical spreads can be more difficult since the skew is against you. That means you’re buying the lower strike price call with higher implied volatility and selling the higher strike price call with lower implied volatility. That means that you’ve lost your edge. In this circumstance, buying the leveraged ETF makes some sense, particularly following a larger correction. However, that doesn’t mean option trades are out.

The same implied volatility skew that exists in ETFs like the iShares Russell 2000 ETF (NYSEARCA: IWM) exists in funds like TNA. That means you can add the potential positive compounding with a trade that will benefit from the skew. This is achieved using call ratio backspreads. For this strategy, the higher implied volatility option is sold, and two lower implied volatility options are bought. This trade is put on for a small net credit that removes the downside risk and has unlimited upside. The steeper the skew, the tighter the spread between your strikes.

Conclusion

Understanding the impact of daily resetting of leverage ETF products is crucial if you’re trading them. The resetting feature allows them to track the daily performance quite closely, but it also leads to the daily compounding of returns over time. The result could be significant underperformance or outperformance depending on the volatility of the price movement. The more volatility, the more potential for underperformance. The lower the volatility, the better the potential outperformance. Finally, utilizing option strategies like verticals and backspreads, that benefit from skew, will allow you to enhance your returns even more with lower risk.