Idea: Trading crude oil

Factors:

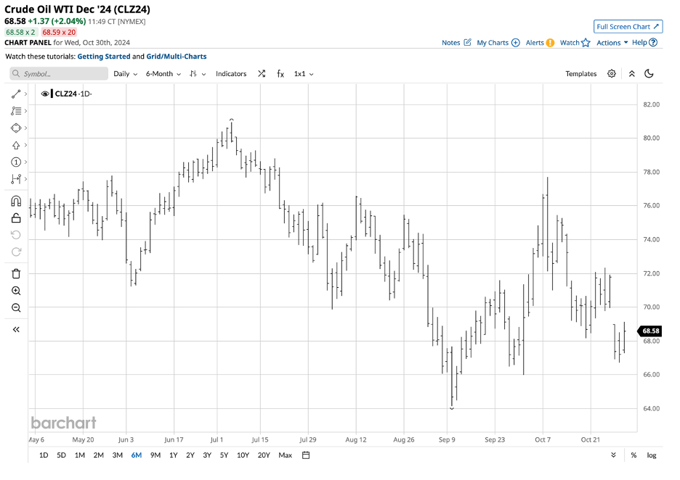

- Nearby NYMEX crude oil futures have traded around the $70 per barrel level since late August.

- The November 5 U.S. election could determine the path of least resistance of crude oil prices as U.S. energy policy is on the ballot.

- Vice President Harris favors continuing the Biden administration’s energy policy, which addresses climate change by supporting alternative and renewable fuels and inhibiting the production and consumption of fossil fuels.

- Former President Trump favors a “drill-baby-drill” and “frack-baby-frack” approach to achieve energy independence and increase U.S. exports.

- A Harris win would likely keep petroleum pricing power with OPEC+, keeping prices stable or elevated.

- A Trump win would likely considerably increase U.S. output above 13.5 million barrels daily, pushing oil prices lower.

- Chinese demand and war in the Middle East are other factors impacting petroleum prices.

Idea: Trading crude oil on the election results

- The NYMEX crude oil futures and futures options are the most direct route for crude oil trading.

- The USO ETF moves higher and lower with nearby NYMEX crude oil prices.

- The bullish UCO ETF product is a double-leveraged product that outperforms NYMEX crude oil futures on the upside on a percentage basis.

- The bearish SCO ETF product is a double-leveraged product that outperforms NYMEX crude oil futures on the downside on a percentage basis.

- Leverage involves time decay, making time and price stops necessary.

Risk-reward:

- Trading instead of investing in crude oil is likely the optimal approach in the current volatile environment.

- A disciplined approach requires profit and acceptable loss levels at trade execution.

- Adjusting stops and profit horizons are appropriate when the market moves in the anticipated direction.

- Stick to stops when the price moves contrary to the expected direction to limit losses.

The November 5 U.S. election could cause significant price variance in oil futures, as the U.S. is the world’s leading crude oil consumer. Energy policy over the coming years will determine whether OPEC+ retains pricing power or if the United States taps its reserves and makes the cartel’s production policy less influential.