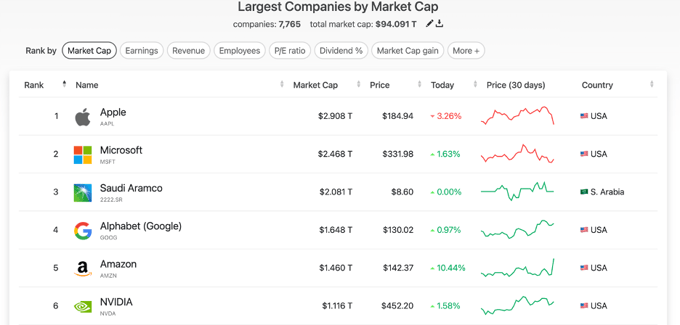

Source: companiesmarketcap.com

There are six publicly traded companies in the trillion-dollar market cap club. Managing a trillion-dollar company is like steering a giant ocean liner; the current economic and political environment amounts to rough seas. Last week, Apple (AAPL), the leader, and Amazon (AMZN), with the fifth top valuation, reported second-quarter earnings. AAPL and AMZN trade on the tech-heavy NASAQ, and the shares went in opposite directions after the latest earnings reports.

The trillion-dollar club attracts lots of investment and speculative interest, and the path of least resistance of these stocks can determine the overall stock market trend over the coming weeks.

Apple revenues fall for the third straight quarter

- Apple’s fiscal Q3 revenues came in at $81.80 billion, above the consensus $81.55 billion forecasts; they were lower than the $82.95 billion in fiscal Q3 2022.

- Adjusted EPS at $1.26 per share beat forecasts for $1.20 and were above the $1.20 in fiscal Q3 2022.

- iPhone revenue was disappointing at $39.67 billion. It was lower than the $39.79 forecast and the $40.67 billion in fiscal Q3 2022.

- Apple shares closed at $191.17 on August 3 before earnings and closed lower at $181.99 per share on Friday, August 4, after the market digested the latest earnings report.

Amazon did far better for the quarter

- Amazon reported net sales of $134.38 billion versus expectations of $131.63 billion, above the company’s guidance range of $127 to $133 billion.

- Diluted EPS came in at $0.65 per share versus forecasts for $0.35.

- AMZN’s web services net sales, operating margin, and operating income exceeded the market’s consensus expectations.

- Amazon shares closed at $128.91 on August 3 before earnings and closed at $139.57 on Friday, August 4, after digesting the latest quarterly earnings report.

Mixed Signals for the NASDAQ

- AAPL fell 4.8% after earnings from August 3 to August 4.

- AMZN shares moved 8.3% higher after earnings from August 3 to August 4.

- AAPL’s market cap is over twice AMZN’s and is a more widely held stock in portfolios and ETF holdings.

- The NASDAQ edged 3.6% lower from 13,959.72 on August 3 to 13,909.24 on August 4.

The divergence reflects the overall market sentiment

- The leading stock market indices have posted impressive gains in 2023, with the NASDAQ leading the way on the upside.

- Stock market investors are highly sensitive to earnings.

- While better-than-expected results should continue to favor higher share prices, disappointing results could cause significant corrections in the current environment.

- The 2023 stock market rally has lots of positive expectations in its sails.

Macroeconomic forces remain questionable

- The Fed increased the Fed Funds Rate by 25 basis points in July continuing a hawkish path.

- The stock market has ignored the Fed. While fighting the central bank’s monetary policy has never been optimal, it has been the correct course in 2023.

- Any economic slowdown could cause stocks to correct if optimism turns negative quickly.

- The reactions to the latest APPL and AMZN earnings reports tell us the market will chase better-than-expected earnings and punish companies that do worse than forecasts.

Thanks for reading, and stay tuned for the next edition of the Tradier Rundown!