In March 2022, the short-term Fed Funds Rate was at a midpoint of 0.125%, with a range of zero percent to twenty-five basis points. As the U.S. inflation rate rose to the highest level in four decades, the central bank took aggressive hawkish action, and at the end of 2022, the Fed Funds Rate was at a 4.375% midpoint.

The trajectory of the increase and $95 billion in quantitative tightening to reduce the central banks’ swollen balance sheet weighed on the stock market, pushing the leading indices significantly lower. The market’s sentiment at the beginning of 2023 is decidedly bearish. The path of least resistance of the stock and bond market is in the hands of the Fed’s economists as we head into 2023.

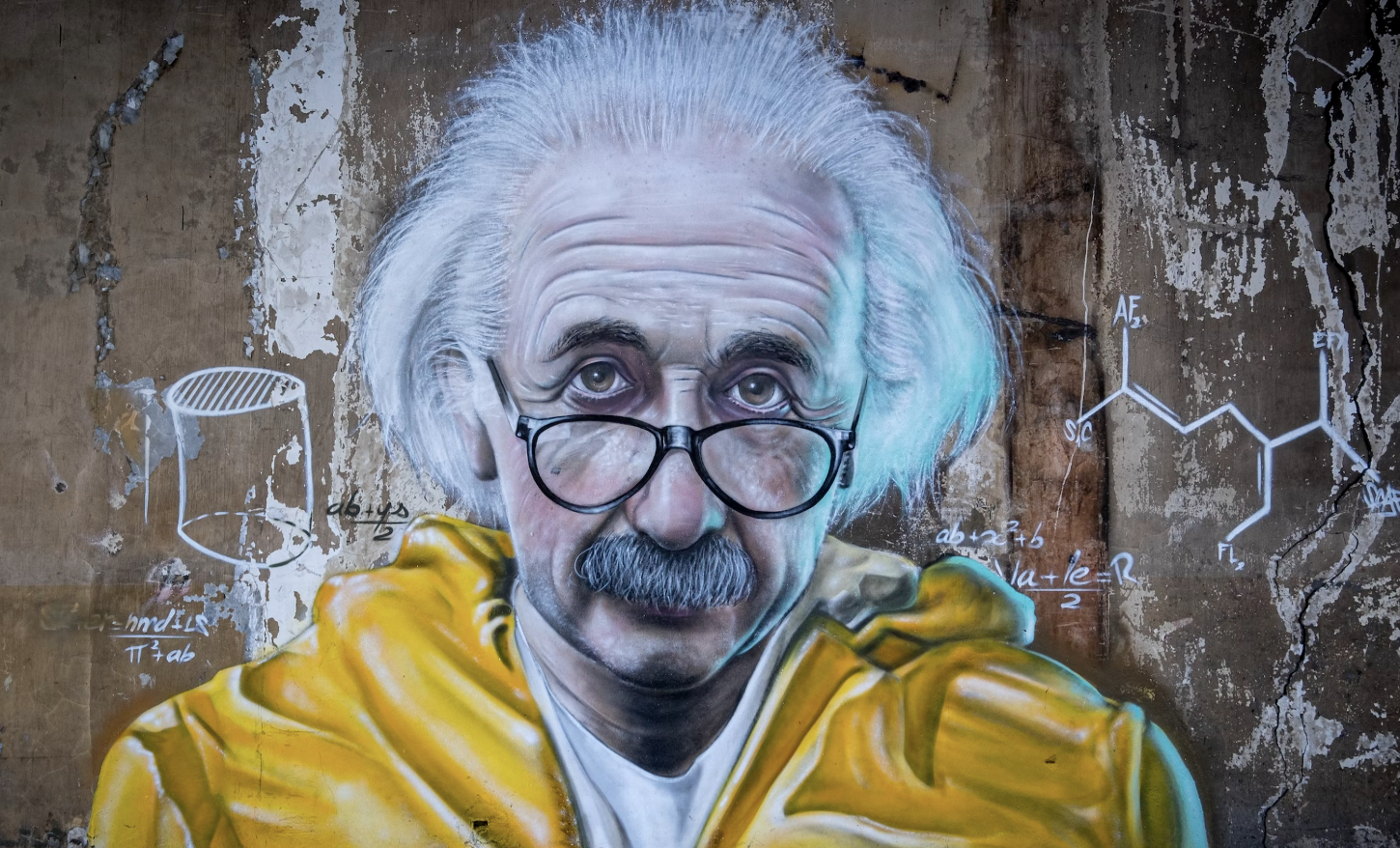

The definition of insanity

- Albert Einstein was one of the greatest and most influential physicists of all time, best known for developing the theory of relativity.

- Einstein said, “Everything should be made as simple as possible, but not simpler.”

- He also defined insanity as “doing the same thing over and over and expecting different results.”

Mistakes in 2021 and a potential of a repeat in 2023

- In 2020, the U.S. Fed and worldwide central banks reacted to the global pandemic with a liquidity tsunami. Governments provided a tidal wave of stimulus to stabilize the economy.

- The pandemic-inspired policies ignited the most significant inflationary pressures in four decades.

- In 2021, the Fed and the U.S. Treasury wrote of inflation as a “transitory,” pandemic-related event.

- In early 2022, the shock of the war in Ukraine poured fuel on the inflationary fire because of supply-side food and energy factors. Ignoring inflation in 2021 turned out to be a mistake.

Inflation and recession require the opposite monetary policy tools

- Battling inflation requires a hawkish monetary policy.

- Higher interest rates cool the economy but also increase the potential for a recession.

- A recession requires a dovish monetary policy.

- At the December FOMC meeting, the Fed continued its hawkish path, with seventeen of nineteen Fed officials expecting a Fed Funds Rate above the 5% level in 2023.

- After ignoring inflation in 2021, the central bank neglected recessionary pressures in late 2022.

Hope for the best

- The Ukraine war and the Chinese-Russian alliance were a shock in 2023- Surprises tend to create the most significant market volatility.

- An end to the war in 2023 would present a best-case scenario over the coming weeks and months.

- The markets would welcome a warming of relations between the U.S. and China, the world’s leading economies.

- Ending China’s COVID-19 protocols should ignite global economic growth but could exacerbate inflationary pressures.

Prepare for the worst, which could be the best case for long-term investors

- The war in Ukraine, the bifurcation of the world’s nuclear powers, and the hawkish U.S. Fed have created bearish market sentiment going into 2023.

- The overwhelmingly bearish sentiment could create sudden and severe rip-your-face-off rallies in stocks and bonds when the markets run dry of selling.

- If stocks and bonds continue to make lower highs and lower lows, or spike to the downside, it should create long-term investment opportunities.

- 2022 was a year of bearish surprises; surprises in 2023 could be bullish.

- Investors and traders should hope for the best, as optimism is healthy, but they must also prepare for the worst, as protecting capital is critical for long-term success.

- The U.S. Fed takes a reactive and data-driven approach. If a deep recession grips markets, it will validate Einstein’s definition of insanity. After ignoring inflation was a mistake in 2021, neglecting a recession in 2022 could be another error.

- Markets are real-time indicators of the sentiment and current economic landscape. A proactive Fed approach would require attention to current market dynamics instead of a review of what has already occurred.

Thanks for reading, and stay tuned for the next edition of the Tradier Rundown!